Capitalix Review 2024 – Learn more about Capitalix Now!

indepth review of this CFD brokerage

Capitalix review 2024

Capitalix places the utmost importance on the care of each client, ensuring their goals are their top priority as well. Their commitment to expertise is reflected in our trading platform, providing an intuitive trading experience. With a dedicated multilingual support team,

- Trading conditions

- Trading tools and Platform

- Fees and commissions

- Safety and security

- Customer Support

They ensure that clients from diverse backgrounds receive personalized assistance. By maintaining a workable trading environment and offering a wide range of assets, They empower our clients to explore the diverse world of CFDs trading.

Capitalix Review 2024: Unbiased Pros and Cons Overview

At Ethereum Broker review, we adhere to rigorous criteria to guarantee a fair and unbiased review procedure. Our evaluation of each broker encompasses a thorough analysis across four crucial areas. The overall score for each broker is determined by assessing distinct factors.

In this Capitalix review, you will find the results of a period that the ethereumbrokerreview.com team of experts has spent studying the broker’s quality.

Don’t forget to leave a comment at the end of the post. Share your honest opinion about Capitalix or ask specific questions if you can’t find an answer on our site.

The best thing to do is to open a free demo account (74-89% of retail CFD accounts lose money) to try Capitalix platforms first-hand and understand this review.

Our opinion on Capitalix

Capitalixis is a broker that only offers CFD trading. This broker stands out for its affordable spreads, which are great for scalpers, starting from 0.5 pips. The broker is free of trading commissions.

In addition to an impressive range of account types available to suit all needs, the Capitalix account is ideal for new traders looking for lower-risk trading.

Pros and Cons of Capitalix.com

Advantages

This broker does not charge trading fees. Additionally, the broker is quite accommodating to various trading strategies, such as hedging, scalping, and using algorithms.

In terms of access, Capitalix welcomes traders globally, with minimal restrictions based on geographic location. Moreover, users can benefit from the broker’s trading platform, which is designed for ease of use, making it an excellent entry point for beginners.

Inconvenience

Starting with the negatives, this broker lacks highly advanced analytics features for trading. These are limited.

If you can overlook this critical point, then this broker has a great chance of being a good choice for you in trading.

Advantages and Disadvantages of Capitalix

Scalping: Capitalix allows and offers VPSPoCo marketplaces available on Capitalix

Demo Account: Available for every account type

Minimum Deposit: There is a low barrier of $250/250€ to open an account.

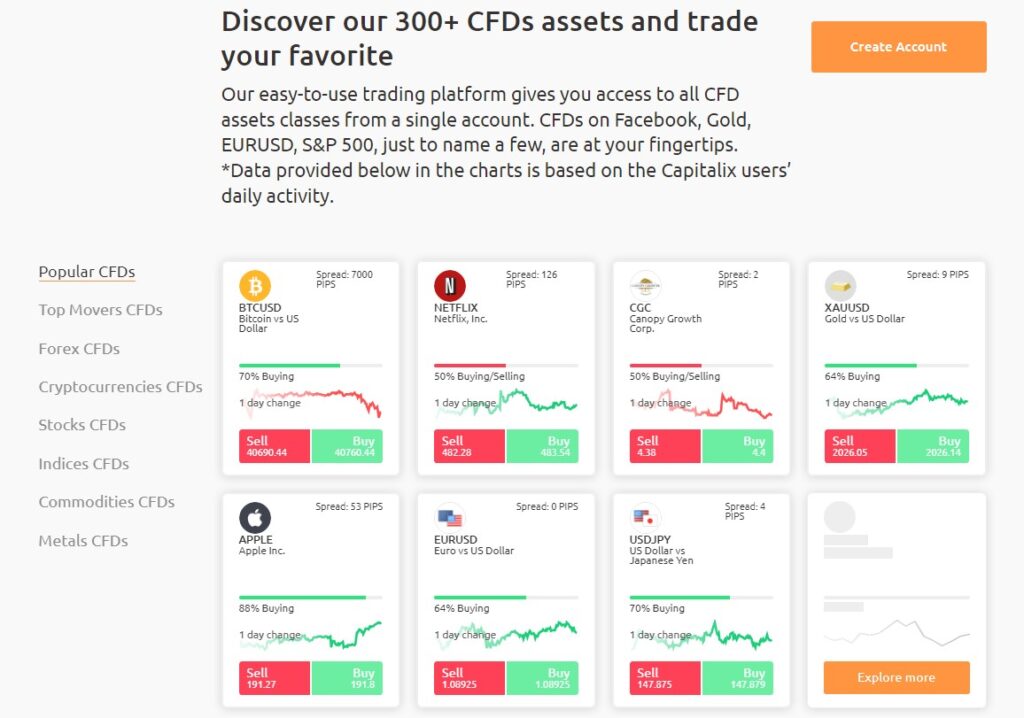

Assets: With this broker, you can trade over 300 CFD assets, including Forex, Cryptocurrencies, Stocks, Indices, Commodities, and Metals, providing a diverse range of trading options for professional investors.

At this broker, clients are presented with three account types: Silver, Gold, and Platinum. Each account type is meticulously crafted to cater to various trading preferences. Please refer to the detailed information for comprehensive insights into these account options.

CFD & Forex Review

You will find various account types when trading CFDs or forex on Capitalix. All assets here are sold as CFDs. The broker offers forex, commodities, indices, stocks, and everything else.

Dynamic variable spreads are available but offer fewer than 300 tradable assets.

It can be a great option if you’re looking for the most commonly traded assets.

Advantages

- Spreads are kept very low here

- The low minimum deposit requirement makes trading accessible to newcomers.

Inconvenience

- Poor education section

- Limited supply of raw materials

SILVER Account Review

The Capitalix SILVER account is ideal for new traders or those who want to get to know the broker better. It is widely accessible and offers an ultra-low minimum deposit of as little as $250/250Є.

It also supports nanolot trading to reduce risk further.

This is the best option if you are learning or trying new trading strategies without wanting to risk large sums of money on total standard lots and trading accounts.

Advantages

- It’s the perfect place to get into the trading world.

- The broker allows for the opening of a virtual account.

Inconvenience

- The spread is larger in this account type than in GOLD and PLATINUM.

Scalping Review

Capitalix excels in facilitating scalping, earning widespread acclaim in this area thanks to its rapid order execution speed of just 0.4 seconds. Implementing market execution further enhances its appeal by eliminating the possibility of requotes.

Despite the constraint in asset variety, these functionalities position Capitalix as a prime broker choice for individuals focused on scalping strategies.

Advantages

- The use of VPS is supported.

- Affordable spreads and no commissions.

Inconvenience

- Limited access to knowledge for beginner traders who wish to learn scalping.

Is Capitalix regulated and legal?

Of course, regulation is a fundamental factor in creating the safest possible trading environment. Capitalix has resorted to regulation from some of the most important regulatory bodies.

- 4Square SY Ltd duly registered in Seychelles with a registration number 8426168-1 holder of an FSA license with number SD052 and registered address at CT House, Office 9A, Providence, Mahe, Seychelles.

- 4Square (CY) Ltd, registered in Cyprus with registration number HE404118 and registered address Laerti 1, Office 2, 3065, Limassol, Cyprus, is acting as a payment agent to 4Square SY Ltd to facilitate payment services to 4Square SY Ltd.

Foundation & Offices

Capitalix was founded in 2023. Since its founding, it has worked hard to expand its offering to traders worldwide. It carries out operations through two offices:

Cyprus

Laerti 1, Office 2, Limassol 3065, Limassol, Cyprus

Seychelles

CT House, Office 9A, Providence, Mahe, Seychelles

Pros

- The broker provides robust negative balance protection for all its traders, ensuring financial safety.

- Capitalix does an excellent job of ensuring first-rate regulation and permanent protection of your funds.

- Their trading services are available in many countries around the world.

- It has won over 40 awards over the years for the high quality of its service.

Contras

- The broker’s physical offices are pretty small, with only two offices.

Account Types

Many account options await, ensuring that you pinpoint the ideal match for your trading necessities.

| Spread in points (as low as) | SILVER | GOLD | PLATINUM |

|---|---|---|---|

| EURUSD | 25 | 13 | 7 |

| GBPUSD | 24 | 12 | 6 |

| USDJPY | 25 | 13 | 7 |

| EURGBP | 24 | 12 | 6 |

| USDCAD | 25 | 13 | 7 |

| USDCHF | 24 | 12 | 6 |

| NZDUSD | 24 | 12 | 6 |

| AUDUSD | 24 | 12 | 6 |

| XAUUSD (Gold) | 74 | 37 | 19 |

| CL (Crude Oil) | 7 | 4 | 2 |

| DAX | 218 | 109 | 55 |

| Leverage (up to) | SILVER | GOLD | PLATINUM |

|---|---|---|---|

| Forex | 1:200 | 1:200 | 1:200 |

| Indices | 1:50 | 1:50 | 1:50 |

| Metals | 1:50 | 1:50 | 1:50 |

| Commodities | 1:50 | 1:50 | 1:50 |

| Shares | 1:10 | 1:10 | 1:10 |

| ETF | 1:10 | 1:10 | 1:10 |

| Cryptos | 1:5 | 1:5 | 1:5 |

Click “Open Account” from anywhere on the Capitalix website and complete the requested basic information. Next, complete registration by verifying your account.

To continue trading, you must select either Virtual or Real mode. The Virtual account allows trading with virtual funds without risks to personal funds.

To Trade in Real Mode, you must deposit funds and complete an online questionnaire. Once received and reviewed by their team, you will be eligible to commence trading.

Demo account ( called Virtual account

The demo account is the ideal place to start if you’re a beginner. Capitalix also offers a demo account that is entirely free and replicates the conditions of actual trading but with virtual funds, without risk, and without the obligation to open an active account when finished.

SILVER account type

The Capitalix SILVER account is a very popular choice among many traders at the broker.

The spreads are also very low, starting from just 2.4pip with fast order execution. You will also have access to a significant maximum leverage of 200:1

GOLD account type

If you are looking for a lower-risk account type in Capitalix, the Cent account is ideal. It is the perfect preliminary account type for most neophyte traders. The minimum Deposit starts at just $250/250Є.

The spreads start as low as 1.2 pips, and orders are executed quickly. Additionally, traders benefit from a substantial maximum leverage of 200:1.

PLATINUM account type

It also allows trading with the lowest possible spread, starting from 0.5 pips, making it ideal if you prefer this type of trading.

As with other accounts, the leverage is up to 200:1.

Capitalix MT5

Trading with the MT5 platform offers numerous benefits, including advanced charting tools, customizable indicators, and a user-friendly interface. Additionally, MT5 supports multiple order types and automated trading strategies, making it ideal for novice and experienced traders. Capitalix offers trading with the MT5 platform, providing traders access to a powerful and versatile trading platform that enhances their trading experience and potential for success.

PAMM accounts

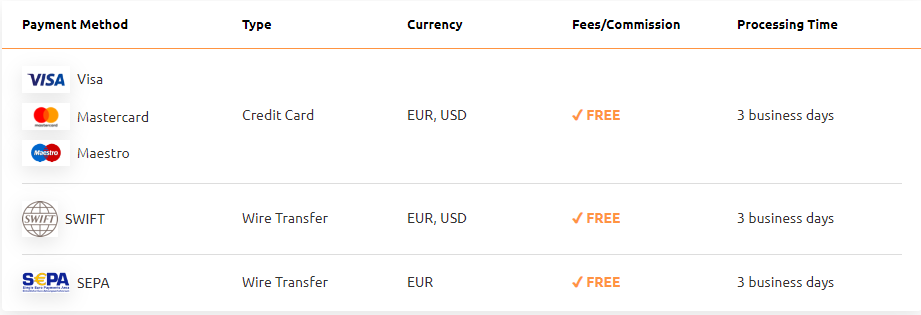

Deposit and Withdrawal

Account Currency

Accounts can be established in either EUR or USD. You’ll be prompted to select your preferred currency when setting up your account. All deposits into your account must be in line with the chosen currency.

Deposit

Let’s discuss the Capitalix minimum deposit and the fees associated with it.

Capitalix Minimum Deposit

The Capitalix minimum deposit is $250 or €250, depending on your chosen account type. This minimum requirement applies uniformly across all account types, ensuring consistency in deposit thresholds.

Deposit methods

Deposit Fees

Deposits are generally fee-free. That said, some of the methods may include a fee.

A conversion fee may apply if you deposit a non-base currency, so check your bank’s fee policy on bank transfers.

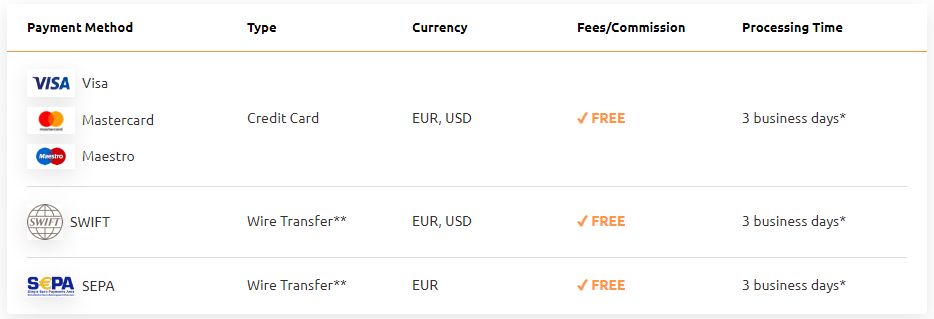

Withdrawals

Let’s discuss Capitalix withdrawal modalities and the fees you may apply.

Modalities of withdrawal of funds

Withdrawal fees

You also won’t need to worry about paying withdrawal fees. If you operate outside of Europe, you may be charged a fee depending on the payment method chosen and a conversion fee if the base currency does not match the currency of your bank account.

Trading Fees

The broker offers only variable spreads starting from 0.5 pips and does not charge commission fees for trading.

The spread is crucial in trading because it represents the difference between an asset’s buying and selling price. It directly impacts the cost of entering and exiting trades, influencing overall profitability. Tight spreads minimize trading costs and allow traders to execute trades at more favourable prices, maximizing potential returns. Therefore, understanding and monitoring spreads are essential for effective risk management and optimizing trading performance.

Non-Trading Fee:

Inactivity Fees

Inactivity fees are applied based on the duration of account inactivity, as outlined below:

– 1 to 30 days: Free

– 31 to 60 days: €30

– 61 to 90 days: €50

– 91 to 120 days: €150

– 121 to 150 days: €250

– 151 to 180 days: €300

– More than 181 days: €500

It’s important to note that trading accounts with a zero balance will not incur any charges. However, the company reserves the right to close accounts with zero balances. Clients will be notified of such actions through the platform and/or via email.

Pros

- Capitalix offers an extensive selection of account types.

- Spreads and trading costs are incredibly low.

- A shallow minimum deposit appeals to traders.

Contras

- The broker does not provide extensive educational materials for novice traders.

- The selection of available base currencies is relatively limited.

Markets

Capitalix is a CFD broker. All assets listed on the platform are offered as CFDs. Here are the available assets.

Forex

Capitalix supports forex trading on over 50 currency pairs.

Commodities

You can trade CFDs on two primary commodities: gold and silver. and soft commodities.

Stock Indices

- NASDAQ 100 100 Most Traded Companies on the NASDAQ

- SPX 500 Index of the 500 largest U.S. companies (by market capitalization)

- UK 100 Index of the 100 largest companies in the U.K. (by market capitalization)

- Germany 30 Index of the DAX (30 companies with the largest market capitalization in Germany)

- EURO STOXX 50 Index based on the 50 most important stocks from the countries of the Eurozone

Stock’s CFD’s

This broker enables trading shares from the world’s largest corporations, such as Facebook, Apple, Google, Microsoft, Netflix, and Alibaba.

Cryptocurrencies

Regarding cryptocurrency markets available on Capitalix, you can trade all the major cryptocurrencies, including Bitcoin, Ethereum, and others (all as CFDs).

You can trade more than 100 crypto assets as CFDs. These include crypto-to-crypto, crypto-to-fiat, and even crypto-to-metals and other assets. The trading market for these assets operates 24/7.

Execution, leverage, and position sizing

Here are some key trading features you can expect when you start trading with Capitalix.

Executions

Capitalix is a CFD broker. This allows you to get the best possible asset prices and a competitive spread as the broker trades with some of the top liquidity providers to ensure you get the best prices.

Leverage

This broker allows trading with leverage up to 200:1. This is crucial because it amplifies the potential profits from successful trades, allowing traders to control larger positions with less capital. However, using leverage responsibly is important, as it also increases the risk of losses.

Size

The minimum trade size on Capitalix will depend on the type of account you choose, although generally, it will be one micro lot, which equates to 0.01 standard lots or a cash value of $1,000 (without leverage).

Risk Management

When managing your trading risk, Capitalix uses all the tools offered by trading platforms to guarantee you as many security options as possible for managing your positions. This encompasses features such as setting stop losses, taking profits, placing limit orders, and using trailing stops to assist you in managing your trades effectively.

Capitalix also offers margin calls if you use leverage on your trades. This ensures that your capital will not fall below a certain level.

Prohibited Trading Techniques

Capitalix supports all types of trading techniques you would like to use. These include hedging and scalping.

Mobile Platforms & Devices

Capitalix also offers several excellent trading platforms from a wide variety of mediums.

Charts & Trading Tools

Since the broker mainly offers the Easytech platform, you can count on a comprehensive collection of customizable charts and a wide variety of trading tools to get the most out of the platforms.

The Trading platform

the easytech trading solutions has been around for some years now and is rightly recognized as one of the top trading platforms in the industry. It’s very lightweight and works on virtually any device. It is also very durable and easy to use and features a high degree of customization if desired.

High Capitalix Leverage

With Capitalix, you’ll have access to one of the highest leverages in the industry(up to 200:1)

Pros

- Thanks to the possibility of trading in nanolots, the broker guarantees the possibility that all budgets can make trades.

- It offers all trading techniques, including scalping and hedging.

- In some cases, it offers a whopping leverage of 200:1.

- Trades are done through highly secure and highly regarded trading platforms.

Contras

- Capitalix is primarily aimed at day trading and swing trading

- It doesn’t offer real cryptocurrencies (CFD certificates)

Customer Service

Languages

The Capitalix website supports English, Spanish, Thai, German, French, |Italian, Portuguese and Japanese.

Customer Service

The customer support provided by Capitalix is professional and easy to contact. It is available through the website’s chat feature and via email or telegram. Although, in this case, the only supported language is English. It also has an extensive FAQ section that will answer many of your questions without contacting support.

The broker offers customer support 24/7 and responds promptly to inquiries. In addition to their fast response times, they provide comprehensive assistance and guidance to clients, ensuring a smooth trading experience. Their knowledgeable support team is dedicated to addressing any issues or concerns promptly and efficiently. Furthermore, the broker is known for its transparency, reliability, and commitment to client satisfaction, making it a preferred choice among traders.

FAQ

How do I open an account with Capitalix?

Click on “Open Account” from anywhere on the Capitalix website and fill out the basic information requested. Next, complete registration by verifying your account.

You will have to select either Virtual or Real mode to continue trading. The Virtual account allows trading with the virtual funds, without risks for the personal funds.

To Trade in Real Mode, you will have to deposit funds and complete an online questionnaire. Once received and reviewed by our team, you will be eligible to commence trading.

Do i need to go through the Know Your Client (KYC) process?

Yes, Capitalix is regulated in Seychelles by the Financial Services Authority. Therefore, every new trader needs to provide proof of identity and proof of residence documents.

The Know Your Client (KYC) process is an industry-standard for all regulated platforms. This regulation is used to protect your identity and ensure that your trading environment is a safe one.

What can I trade on Capitalix?

The platform offers a diverse range of tradable assets, including forex, stocks, cryptocurrency, commodities, and indices, totaling 350+ assets.

Can I trade Bitcoin CFD?

Bitcoin, along with other cryptocurrencies, is available for trading on the platform as a currency pair (e.g., BTC/USD).

Comments are closed, but trackbacks and pingbacks are open.